We all want the highest return from an investment but we often fail to do so because of lack of expertise. We are going to look at some of the ways to get the highest return on investment when investing in a fixed deposit.

FD rates today are on a downward spree because of economic uncertainty, therefore making it imperative for you to find out smart ways of investing in fixed deposits in order to maximise your returns from the investment.

Even though FD is one of the risk-free & Smart investments, there are various things that you should keep in mind before investing in a fixed deposit to get the highest returns.

Before you decide to invest, you should use tools like the online FD calculator to calculate your returns in advance. Also, look out for higher FD rates, in comparison to post office fixed deposit interest rate.

Smart Ways to Invest in Fixed Deposit:

Put as little as R1 000 to work for you, for a period of one month to 17 months and enjoy the benefits and returns of a fixed interest rate. If you add more money to a Fixed Deposit, we will re-invest the sum of your old and new investment for the tenure you choose. Can I liquidate before the end of my investment tenure? Depending on the plan you're on, some charges may apply. For example, a penal charge of 30% of the total accrued interest will be charged on Fixed.

Online Fixed Deposit Calculator:

- Let us understand fixed deposits and other options, before making your final investment choice. What is a Fixed Deposit. A fixed deposit is a financial instrument, wherein you deposit your money with a bank, post office or financial institution, for a fixed term at a fixed.

- Investment Return is Guaranteed. One of the worries when investing is: “Will I get my money back?”.

You should use anonline FD calculator to calculate the amount of interest you are going to get at the end of maturity. You can also get information on the FD rates if you investtoday. OnlineFD calculators can also help determine the terms on which you want to invest.

It also helps you choose the type of fixed deposit. On the website of Bajaj Finance, you can access one of the most easy-to-use online FD calculators which have all the features that you need to calculate your return on investment.

Online Application Process

The smart way of investing in fixed deposit is avoiding queues and investing online. You can get the complete investment experience while sitting at your home. You can apply through an online portal and then a company representative will get back to you. And you can even pay online for your fixed deposit. You should use this online fixed deposit as it is very convenient.

Multi Deposit Facility:

You can avail a multi deposit facility to save yourself from the loss of interest when you break your fixed deposit prematurity. You can open multiple fixed deposit accounts when you invest in a fixed deposit through a single cheque. And if you need money due to an emergency in an unfortunate circumstance you don’t have to break all your FDs and incur losses in the form of reduced interest rates.

The reason for this is, each fixed deposit is considered as a separate FD so you can easily invest in multiple fixed deposit accounts and you can also choose different terms for these fixed deposit accounts.

Choose a Scheme with Higher Rate of Interest

There are various schemes that are available in the market for you to choose from. Customised schemes give you a higher rate of interest. For example, Senior Citizen Fixed Deposit by Bajaj Finance has one of the highest rates in the industry, i.e. 7.85% for 5 years FD, which is 0.25% higher than regular FD rates. It is also much higher than the post office fixed deposit interest rate which is currently 6.7% for a 5-year deposit.

There are many smart ways to invest in a fixed deposit through which you can avail of the highest FD rates today. You should always keep an eye on the latest schemes that are initiated by the government and companies. You should always use an online FD calculator to calculate the amount of interest that you will get at the end of maturity.

You should avail facilities like multi deposit facility to have convenience while investing. Schemes that are meant for senior citizens such as Bajaj Finance Senior Citizen Fixed Deposit have a higher rate of interest.

Theconventional wisdom suggests, whenever you have some savings in hand, invest itin a fixed deposit. Yes, fixed deposits have been a great investment productsince ages (and still are), but you should also explore other investmentproducts, and then finally make your investment choice. Who knows, you may getyour hands at something better.

Letus understand fixed deposits and other options, before making your finalinvestment choice.

What is aFixed Deposit

Afixed deposit is a financial instrument, wherein you deposit your money with abank, post office or financial institution, for a fixed term at a fixed rate ofinterest. The interest rate on a fixed deposit is higher, in comparison with asaving account. Your money is locked for the fixed term chosen by you. If youwant to withdraw before end of the fixed term, then it can generally be donewith a penalty (The conditions vary from bank to bank).

NBFC(Non-Banking Financial Corporations) also offer fixed deposits. The companyfixed deposits generally carry slightly higher interest but higher risks also.The Bank fixed deposits are generally considered relatively safer.

Fixed DepositInterest Rates

Theinterest rates for fixed deposits keep on changing regularly. Interest ratesfor senior citizens are higher by at least 0.25% than what is offered to normalcitizens. Here are the links to fixed deposit interest rates of some majorbanks.

- ICICI Fixed Deposit Interest Rates

- PNB Fixed Deposit Interest Rates

- Canara Bank Fixed Deposit Interest Rates

- Andhra Bank Fixed Deposit Interest Rates

- Bank of Karnataka Fixed Deposit Interest Rates

- Dena Bank Fixed Deposit Interest Rates

Fixed DepositMaturity Calculator

Thematurity value of the fixed deposit can be calculated using the calculatorsavailable on various bank websites and other financial websites. Some of thefixed deposit maturity value calculators are as following:

HDFC FD Maturity Value Calculator

ICICI FD Maturity Value Calculator

Ask us any question related to fixed deposit.

How to open aBank Fixed Deposit

Abank fixed deposit can be opened conveniently by visiting a bank branch. Now adays a bank fixed deposit can also be easily opened online using internet banking.

When youshould invest in a FD

- Guaranteed returns: Invest in a fixed deposit, when you want fixed returns.

- No Risk Investment: You can invest in a fixed deposit, where you do not want to take risk.

- Loan against Fixed Deposit: You can invest in a fixed deposit and get a loan against the fixed deposit. Loan of up to 90% value of FD amount is generally sanctioned.

- Maturity Date: You can select the FD tenure as per your financial need and plan to get the maturity amount exactly when you need.

- Liquidity: FD provides liquidity option. Although the amount is fixed for the selected tenure, still the investor can liquidate the FD anytime in between. Although banks may charge some penalty for breaking the FD in between.

When youshould NOT invest in a FD

- High Returns: Do not invest in a FD, when you are chasing high returns. There are plenty of options available which can get you way higher returns, in comparison to FD.

- Taxation: FD's attract income tax. Hence if you are in a higher income tax slabs, then effective yield of fixed deposit is very low, post income tax.

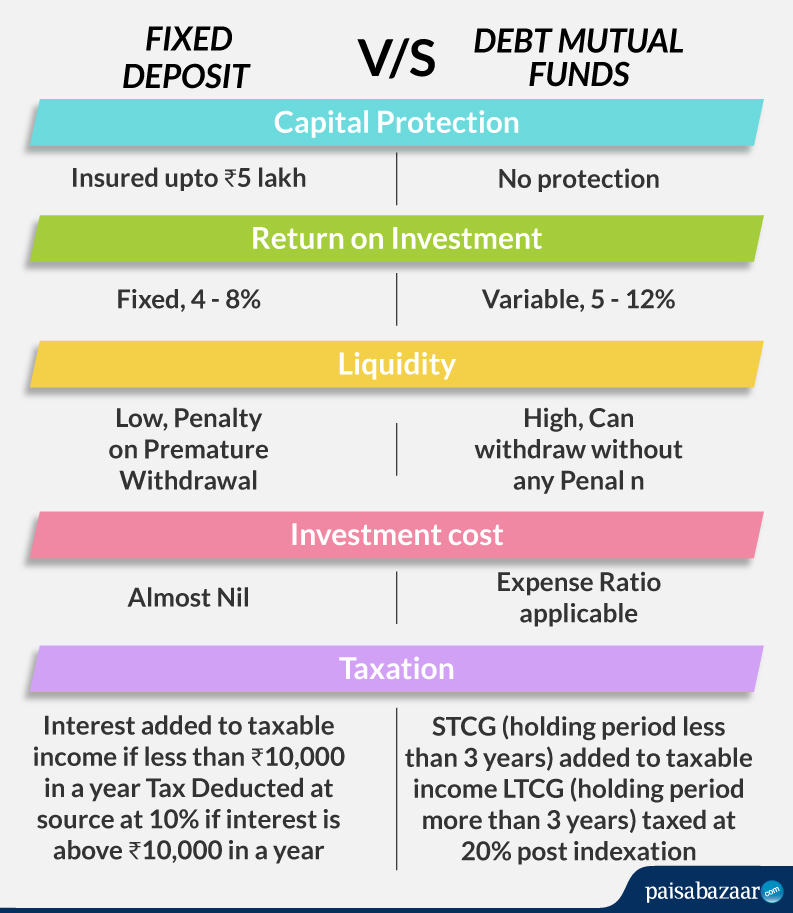

- Higher risk capacity: You should explore options, other than FD, in case you can go for a bit higher risk on your investment. For example, you can invest in equity mutual funds, if you want higher returns and can take higher risk. Similarly, debt mutual funds can be selected in case of a balance between returns and low risk is desired.

- Long Tenure of investment: If you are investing for a medium or a long term and are not risk averse, then you may explore mutual fund options. Mutual funds generally give good returns in long term.

Alternativesto Fixed Deposit

Generally,as conventional investors and lack of financial knowledge, our inclination istowards fixed deposit. Investors can explore other options available in marketas per their need.

a. Debt Mutual Funds

Debtmutual funds invest in instruments, which are safer and provide comparativelystable returns like corporate bonds and Government securities. These mutualfunds can provide higher returns compared to fixed deposits. Liquidity is alsobetter in case of open ended debt funds, which can be redeemed anytime.

b. Equity Mutual Funds

Equitymutual funds invest in equity (Share) markets. These are high risk and highreturn investment. If you are investing with long term horizon and want reallyto create wealth, then you can go for equity mutual funds. The risks canbe reduced by investing in form of a SIP (Systematic Investment Plan). However,you should develop a basic understanding of mutual funds before investing.

c. Corporate Fixed DepositInvestorswilling to go for a little higher risk and wanting a little higher return, canexplore the option of corporate fixed deposits also. Corporate fixed depositsoffer higher interest rates compared to a bank fixed deposit.

d. Fixed Maturity PlansFixedMaturity plan invest in debt instruments, which provide higher security andfixed returns. However, unlike FD's where you get guaranteed maturity amount,fixed maturity plan give indicative maturity amount. But the investment cannotbe liquidated in between tenure. Hence invest in these only when you are surethat money will not be required in between.

e. PublicProvident Fund (PPF)Ifthe purpose of investment is for long term needs, like retirement planning,then you can open a PPF account also. The returns on PPF are higher than of FD.Returns on PPF are tax exempt, unlike FD. PPF has a lock in of 15 years, butthe loan facility is available from 3rd to 6th year from opening account. From7th year partial withdrawal is allowed.

f. GovernmentBondsTheseare a good alternative to fixed deposit as the returns are higher. But the lockin period in case of Government bond is longer. Also, government bonds aregenerally subscribed by Banks and big financial institutions and are many timesout of public reach.

Standard Bank Fixed Deposit Investment

h. NationalSaving Certificate (NSC)NSCis issued by post offices. NSC offers a bit higher returns than FD. They havetax saving advantage. They have lock in period of 5 years.

Conclusion

Manyinvestors as per conventional wisdom invest in FD without exploring otheralternative options. In current scenario when the interest rates are goingdown, the FD has become a less attractive investment option.

Ifyou are striving for higher returns, and ready to take a bit more risk, then markethas plenty of attractive alternate options.

Contact us to invest better. We will be happy to help.

Further Suggested Reading

Why Should I Invest ?

Where Should I Invest ?

How Should I Invest ?

How much Should I Invest ?

When Should I Invest ?

What Is Fixed Deposit Investment

Mutual Fund Basics.

- How to select best performing mutual funds for investment?

Home- Investment Nirvana! Financial Planning based investing.

We will be happy to answer all your questions related to Financial Planning, Mutual funds & Investing.

Best Fixed Income Investments

Please ask in form below.

We will be happy to answer all your questions related to Financial Planning, Mutual Funds & Investing.