Comparison of 1-year CD APYs. Bank of America. Bump rate CD Don’t miss out if rates rise. When you open a Bump Rate CD, you’ll get a high yield, plus the option to lock in a one-time bump if our rates go higher. Rates & Info believes that a reasonable early withdrawal fee for a CD of less than one year is 3 months’ interest and a reasonable early withdrawal fee for a CD of 18 months to 5 years is 6 months’ interest.

Available Nationwide, Government Insured - March 6, 2021, 11:41 am PT

q

| Bank | Type | APY | Actions | Last Checked |

|---|---|---|---|---|

| Delta Community Credit Union | 1 Year CD | 0.80% ↓ (down from 0.85%) | Email this rate » Get Rate Alerts » | Mar 4 (2 days ago) |

| Connexus Credit Union | 1 Year CD | 0.71% ↑ (up from 0.61%) | Email this rate » Get Rate Alerts » | Mar 4 (2 days ago) |

| Live Oak Bank | 1 Year CD | 0.65% ↑ (up from 0.50%) | Email this rate » Get Rate Alerts » | Mar 4 (2 days ago) |

| Abound Credit Union | 1 Year CD | 0.65% ↓ (down from 0.70%) | Email this rate » Get Rate Alerts » | Mar 4 (2 days ago) |

| Goldwater Bank | 1 Year CD | 0.65% ↑ (up from 0.60%) | Email this rate » Get Rate Alerts » | Mar 4 (2 days ago) |

| First City Bank | 1 Year CD | 0.60% ↓ (down from 0.85%) | Email this rate » Get Rate Alerts » | Mar 4 (2 days ago) |

| Bank | Type | APY | Actions | Last Checked |

|---|---|---|---|---|

| iGoBanking.com | 1 Year CD | 0.60% ↓ (down from 0.65%) | Email this rate » Get Rate Alerts » | Mar 4 (2 days ago) |

| Synchrony Bank | 1 Year CD | 0.55% ↓ (down from 0.60%) | Email this rate » Get Rate Alerts » | Mar 4 (2 days ago) |

| State Bank of India | 1 Year CD | 0.50% ↓ (down from 0.55%) | Email this rate » Get Rate Alerts » | Mar 4 (2 days ago) |

| Amboy Direct | 1 Year CD | 0.50% ↓ (down from 0.65%) | Email this rate » Get Rate Alerts » | Mar 4 (2 days ago) |

| Discover Bank | 1 Year CD | 0.50% ↓ (down from 0.60%) | Email this rate » Get Rate Alerts » | Mar 4 (2 days ago) |

| Colorado Federal Savings Bank | 1 Year CD | 0.50% ↓ (down from 0.65%) | Email this rate » Get Rate Alerts » | Mar 4 (2 days ago) |

| Bank | Type | APY | Actions | Last Checked |

|---|---|---|---|---|

| Sallie Mae | 1 Year CD | 0.45% ↓ (down from 0.50%) | Email this rate » Get Rate Alerts » | Mar 3 (3 days ago) |

| BAC Florida | 1 Year CD | 0.45% ↓ (down from 0.60%) | Email this rate » Get Rate Alerts » | Mar 4 (2 days ago) |

| PenFed Credit Union | 1 Year CD | 0.45% ↓ (down from 0.50%) | Email this rate » Get Rate Alerts » | Mar 3 (3 days ago) |

| Banesco | 1 Year CD | 0.40% ↓ (down from 0.70%) | Email this rate » Get Rate Alerts » | Mar 3 (3 days ago) |

| Self Help Credit Union | 1 Year CD | 0.40% ↓ (down from 0.50%) | Email this rate » Get Rate Alerts » | Mar 4 (2 days ago) |

| Bank5 Connect | 1 Year CD | 0.40% ↓ (down from 0.50%) | Email this rate » Get Rate Alerts » | Mar 4 (2 days ago) |

| Bank | Type | APY | Actions | Last Checked |

|---|---|---|---|---|

| HSBC Advance | 1 Year CD | 0.40% ↓ (down from 0.50%) | Email this rate » Get Rate Alerts » | Mar 5 (Yesterday) |

| Academy Bank | 1 Year CD | 0.35% ↓ (down from 0.45%) | Email this rate » Get Rate Alerts » | Mar 4 (2 days ago) |

| Academy Bank | 1 Year CD | 0.35% ↓ (down from 0.45%) | Email this rate » Get Rate Alerts » | Mar 4 (2 days ago) |

| CD Bank | 1 Year CD | 0.35% ↓ (down from 0.50%) | Email this rate » Get Rate Alerts » | Mar 4 (2 days ago) |

| Mountain One Bank | 1 Year CD | 0.30% ↓ (down from 0.40%) | Email this rate » Get Rate Alerts » | Mar 4 (2 days ago) |

| Virtual Bank | 1 Year CD | 0.30% ↓ (down from 0.55%) | Email this rate » Get Rate Alerts » | Mar 4 (2 days ago) |

| CIT Bank | 1 Year CD | 0.30% ↓ (down from 0.35%) | Email this rate » Get Rate Alerts » | Mar 4 (2 days ago) |

| Bank | Type | APY | Actions | Last Checked |

|---|---|---|---|---|

| Elements Financial | 1 Year CD | 0.30% ↓ (down from 0.60%) | Email this rate » Get Rate Alerts » | Mar 4 (2 days ago) |

| OneWest Bank | 1 Year CD | 0.25% ↓ (down from 0.30%) | Email this rate » Get Rate Alerts » | Mar 5 (Yesterday) |

| ConnectOne Bank | 1 Year CD | 0.25% ↓ (down from 0.65%) | Email this rate » Get Rate Alerts » | Mar 3 (3 days ago) |

| GiantBank | 1 Year CD | 0.25% ↓ (down from 0.50%) | Email this rate » Get Rate Alerts » | Mar 4 (2 days ago) |

| Popular Direct | 1 Year CD | 0.25% ↓ (down from 0.30%) | Email this rate » Get Rate Alerts » | Mar 4 (2 days ago) |

| PurePoint | 1 Year CD | 0.25% ↓ (down from 0.50%) | Email this rate » Get Rate Alerts » | Mar 4 (2 days ago) |

| Alostar Bank of Commerce | 1 Year CD | 0.25% ↓ (down from 0.30%) | Email this rate » Get Rate Alerts » | Mar 4 (2 days ago) |

| Southeast Financial CU | 1 Year CD | 0.25% ↓ (down from 0.35%) | Email this rate » Get Rate Alerts » | Mar 4 (2 days ago) |

| Nationwide Bank | 1 Year CD | 0.20% ↓ (down from 0.40%) | Email this rate » Get Rate Alerts » | Mar 3 (3 days ago) |

| American Express | 1 Year CD | 0.20% ↓ (down from 0.35%) | Email this rate » Get Rate Alerts » | Mar 4 (2 days ago) |

| Nat'l Bank of Kansas City | 1 Year CD | 0.20% ↓ (down from 0.30%) | Email this rate » Get Rate Alerts » | Mar 4 (2 days ago) |

| MidFirst Direct | 1 Year CD | 0.15% ↓ (down from 0.20%) | Email this rate » Get Rate Alerts » | Mar 4 (2 days ago) |

| Gulf Coast Bank | 1 Year CD | 0.10% ↓ (down from 0.15%) | Email this rate » Get Rate Alerts » | Mar 4 (2 days ago) |

| Citizens Access | 1 Year CD | 0.10% ↓ (down from 0.20%) | Email this rate » Get Rate Alerts » | Mar 3 (3 days ago) |

| Ameriprise Bank | 1 Year CD | 0.10% ↓ (down from 0.15%) | Email this rate » Get Rate Alerts » | Mar 4 (2 days ago) |

| H&R Block Bank | 1 Year CD | 0.03% ↓ (down from 0.30%) | Email this rate » Get Rate Alerts » | Mar 2 (4 days ago) |

| Charles Schwab Bank | 1 Year CD | 0.03% ↑ (up from 0.00%) | Email this rate » Get Rate Alerts » | Mar 4 (2 days ago) |

1 Year Cd Rates 2020

` Contact Us

Contact UsThe current average interest rate on a savings account is just 0.06%, according to the FDIC. It’s no surprise, then, that people often seek another low-risk way to get a larger return on their money. A great alternative to savings accounts is a 1-year certificate of deposit (CD). A CD is much like a savings account, except you lock your money into this account for a minimum of 1 year. After the 12 months is over you can withdraw your money and the interest or roll it over into another year.

Advertiser Disclosure |8 Best 1-Year CD Interest Rates for September 2020

Rates data as of 8/26/2020

Is now a good time to save?

Certificates of deposit, or CDs, are a savings deposit that assures your money will grow and gain interest. Due to the Federal Reserve rate cuts in March 2020, many banks dropped the rates they’re offering on their CD products. Credit unions and online banks still yield the best bang for the savings buck.

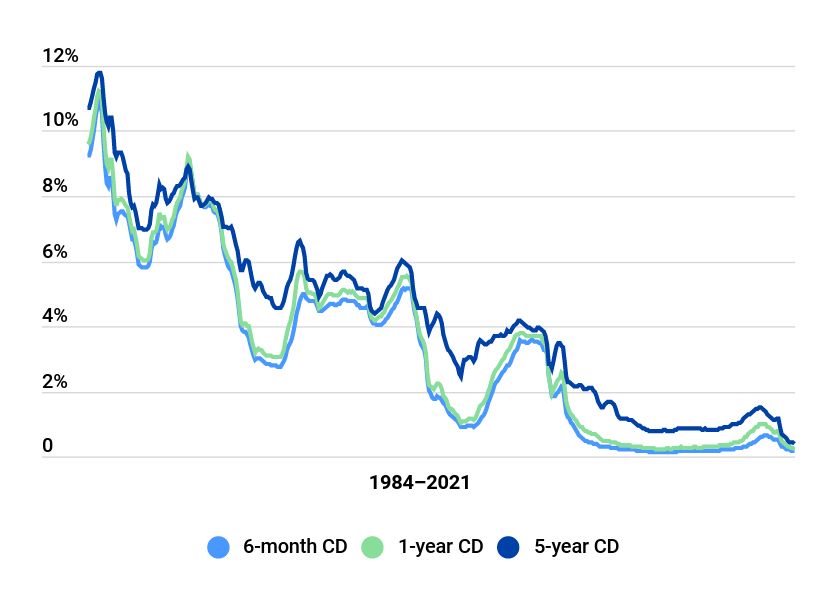

The average interest rate right now is 0.42% for a 1-year CD. A 5-year CD averages 0.60%. Depositing your money in a bank for a fixed period means you will receive a fixed interest rate. While the rate you earn won’t be as high as it has been at some points in recent history, it’s still a good time to help your money grow via that earned interest.

The rate offered on CDs is often higher than the interest earned on most savings accounts, and that includes high-yield savings accounts. It’s a good way to save and earn if you can stow away that money for one year — provided you won’t need access to that money right now.

Ally – 0.75% APY

Ally’s 12-month high-yield CD not only offers a competitive interest rate, but it comes with the company’s “Ten Day Best Rate Guarantee,” which states as long as you fund your CD within the first ten days of opening your account, you’re guaranteed to be given the best 12-month CD rate Ally offers for your term and balance tier, even if it goes up. You’ll also be given compounding interest on your balance, and the account doesn’t come with any pesky monthly maintenance fees.

Barclays – 0.40% APY

Beginning investors, or those who don’t have a ton of money to store away, may be interested inBarclays CDs — specifically its online options. Their 1-year CD option comes with a healthy annual percentage yield and there is no minimum amount required to open the account, which means that you’re free to put away as much or as little as you wish. In addition, though the CD itself only lasts for one year, Barclays also offers a ladder option, which allows you to free up or choose to reinvest your earnings as the CD matures.

Capital One – 0.50% APY

Though the annual percentage yield isn’t as high forCapital One’s 1-year CD, it’s worth noting that this choice offers more flexibility than some of the other best 12-month CD rates that are currently on the market. With Capital One, you can choose how you want your interest to be paid out, whether it’s at the end of the term, on a monthly basis or annually. You can also rest easy knowing that all of Capital One’s CDs are FDIC-insured up to the allowable limit of $250,000.

Charles Schwab – 0.15% APY

Charles Schwab does its CDs a little bit differently than most of the other financial institutions on the market. Rather than offering CDs in year-long installments, they offer the flexibility to go month-to-month. Though we’re talking about the best 12-month CD rates, it’s worth noting that you have the option to renew your CD for anywhere from one month to 20 years. That said, Charles Schwab accounts do come with a minimum balance requirement of $1,000.

Discover – 0.80% APY

A big selling point behind Discover’s product is not only it’scompetitive 12-month CD rate, but also the amount of transparency that the company has online. Not only does Discover’s online presence list the benefits of opening an account with Discover — such as not having any monthly maintenance fees or having a calculator that lets you see exactly how much interest your deposit will earn over the term of the CD — but it also shows you the potential downsides of opening the account. For example, its website lists how much interest you’ll be charged if you withdraw from your account early, allowing you to make a fully informed decision about where to put your money.

Marcus – 0.85% APY

Marcus by Goldman Sachs CD’s minimum amount required to open an account is lower than the usual. Its 1-year CD minimum deposit is just $500, which is roughly half as much as some of the other high-yield CD options on this list. CDs through Marcus by Goldman Sachs are only available online (as of writing), which could be a drawback for some who prefer a more hands-on approach to their money. Marcus by Goldman Sachs does offer a 10-day CD rate guarantee, an online calculator to see how much you’ll earn, and a US-based customer service center that is open every day.

Synchrony – 0.75% APY

Synchrony Bank has CDs available for a minimum deposit of $2,000, which is much higher than the usual minimum deposit, sometimes as low as $500. However, Synchrony does have a 15-day best rate guarantee and an online calculator. At Synchrony, you might fare better with a high-yield savings account where you’ll earn 1.05% APY and have no minimum balance.

TIAA Bank – 0.60% APY

Requiring a $5,000 deposit in order to open the account definitely guarantees TIAA bank the award for the highest minimum deposit requirement on the list. However, if you have the funds, it may be worth the investment.TIAA Bank offers a few features that set it apart from its competitors, including a 20-day maturity alert, which will give you enough time to plan to free up your funds, if needed. Plus, CD accounts with TIAA are IRA-eligible.

Compare the 8 Best 1-Year CD Rates for September 2020

- Ally: 0.75% APY, $0 minimum deposit

- Barclays: 0.40% APY, $0 minimum deposit

- Capital One: 0.50% APY, $0 minimum deposit

- Charles Schwab: 0.15% APY, $1,000 minimum deposit

- Discover: 0.80% APY, $2,500 minimum deposit

- Marcus: 0.85% APY, $500 minimum deposit

- Synchrony: 0.75% APY, $2,000 minimum deposit

- TIAA Bank: 0.60% APY, $5,000 minimum deposit

1 Year Cd Rates 2018

What is a 1-Year CD?

A 1-year CD is simply a short-term certificate of deposit. Like other CDs, this financial product promises to provide investors with higher-than-normal interest rates, provided that they keep the money in the CD for its entire term.

This 12-month CD investment could be useful if you have a lump-sum of cash that you won’t need to access for at least a year, such as a work bonus or a cash gift. While certificates of deposits can offer a great return on investment, you’ll likely be subject to penalties if you decide to pull the money out before the term of the CD is over. You can use our CD interest rate calculator to see how much interest you’ll earn over the course of a year or longer.

CDs vs. Other Accounts

1-Year CDs vs Savings Accounts

1 Year Cd Rates 2016

Put simply, the rates savings accounts offer are not usually as high as what you might find with a CD or when compared to a 1-year CD. However, in return for those lower rates in traditional savings accounts, you do get some added flexibility. While there may be limits on how many withdrawals you can make per month, there are no penalties for withdrawing your money from a savings account. This may be a better option if you’re worried that you may have to pull money out at a certain point in time.

1-Year CDs vs Money Market Accounts

Money market accounts (MMAs) are similar to savings accounts in that, while there are limits on the amount of withdrawals you can make per month, as long as you stay within those limits, there are no penalties for accessing your money. Money market accounts also usually have a marginally higher yield than high-yield savings accounts. Plus, some accounts come with the ability to write checks or access your money via a debit card. However, their minimum balances tend to be slightly higher as well, and MMA holders may see penalties or fees for falling below those minimum balances.

1-Year CDs vs 3-Year CDs

The decision between a 1-year versus a 3-year CD boils down to how long you have to put your money away. A 3-year CD will offer better earnings, and usually, a higher interest rate. The longer you can put your money away, the higher the interest rate will be. You’ll get a good return upon maturity of the CD.

The Impact of 0.1% Change on $1,000

When you’re comparing rates between CDs and savings accounts, you may notice that CD rates only promise a marginally higher percentage than a traditional or high-yield savings account. You’re left wondering if locking your money in a CD is really worth it. Believe it or not, even a 0.1% increase in APY rate could have a noticeable impact over the term of your CD. Let’s say you have a 12-month CD worth $1,000 that garners 2.4% APY. In the first year, the value of your CD will increase to $1,024. Now imagine you were able to get a 12-month CD rate of 2.5% APY. At the end of the year, your CD will be worth $1,025. That’s not that great of a difference, but if you have a CD worth several thousand dollars, you can begin to imagine how quickly a few extra percentage points can add up to real cash — especially if you renew the CD.

The final word

Investing your money in a 1-year CD is a good option if you can lock away that money for the duration of the CD. It’s an excellent low-risk way to save and earn, but you’ll lose some or all of the interest you earn if you withdraw the money you deposited before the CD matures.

Cd Rates Florida

You can choose the best CD option for you based on the minimum deposit, interest rate, fees and whether the bank offers a 10-day rate guarantee. The best 1-year CDs have better interest rates than traditional savings accounts, and since CD rates are fixed, you can learn exactly how much you will get in return when the CD matures.